【新唐人2014年05月13日訊】法國媒體報導說,中國城市陷入恐懼,在中國,除了北京、上海、廣州、深圳四大都市之外,其他城市的房地產價格不斷下跌。今年以來,中國陸續出現房企老闆因資金鏈斷裂,欠下巨額債款後跑路的事件。大陸評論人士指出,中國的房地產泡沫破裂迫在眉睫,而中共政權也將隨之崩潰。

法國《世界報》報導說,在江蘇常州市新北區靠近最新修建的高鐵火車站地區,新區的房產售價近期不斷下跌,引發業主的強烈抗議,他們連續幾個週末在新區示威抗議,要求收回他們的血汗錢。一位姓薛的房地產分析師向《世界報》表示,常州地方規劃部門在市區的四角修建了四個可容納三十萬人的新區,這使常州未來好幾年的住房需求都已得到滿足。

大陸媒體《騰訊財經》5月10號報導,山東青島市「君利豪集團有限公司」董事長王莉自4月30號起失去聯繫,經證實,這是又一起房產商因資金鏈斷裂,欠下巨額欠款跑路的案例。報導說,王莉欠下高達12億以上巨額債務,涉及三家以上的國有大型商業銀行,以及多個民間借貸公司和個體。

今年以來,隨著大陸房地產業銷售量嚴重萎縮,庫存高積,房地產商資金鏈頻頻出現問題,房地產業危機影響了上游,業內人士分析,土地市場的拐點已經全面到來。

報導說,5月5號,瀋陽共有五幅土地拍賣,最終四個地塊流拍,而唯一成功拍賣的地塊也是以接近底價成交,總價僅僅93萬元。

瀋陽市國土局公布的信息顯示,這五幅土地有三幅為商務用地,兩幅為商住混合用地,合計拍賣土地面積近10萬平方米。而拍賣起始價最高每平方米僅1,584元,參與現場競拍的只有三家企業。

湖南長沙市工程師蔡立新認同,中國房地產具有嚴重的泡沫。

湖南長沙市工程師蔡立新:「國內的一些鬼城,房屋積壓在那裏,大量的鬼城出現,比如鄂爾多斯、珠海、惠州,那就是說,房子嚴重過剩。泡沫早晚有一天要破裂的。估計不會太遠了。」

江西南昌市商人李少明認為,中共當局不會讓樓市崩潰。他估計從現在往後幾年,其他的物價會漲,但房價不漲,然後造成貶值。

江西南昌市商人李少明:「中國在世界上來講是一種比較特殊的體制,整個中央政權是可以掌控一切資源的。它可以調用的所有資源,它能夠使用的方法,選擇餘地是很大的。」

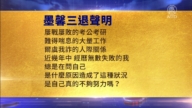

廣東廣州市建築工程管理高級工程師徐琳認為,中國房地產泡沫很快將破裂,他個人預計就在下半年。他表示,房市泡沫破裂必然導致政權的崩潰。

廣東廣州市建築工程管理高級工程師徐琳:「因為中國的房地產跟中國政府是密切相關的。土地的買賣從中獲利,帶有一定的股份。再一個就是很多房地產項目商通過銀行貸款這種方式來運作的。再一個,中國政府對於市場的監管有很多的關卡,通過各種手段去設置關卡,從中牟利。也就是這個政權跟房地產行業千絲萬縷的關係。房地產一旦泡沫破裂的話,這個政權也就會相應的受到牽連。」

蔡立新指出,由於中國房地產跟政府、銀行之間捆綁的關係很大,一旦房地產泡沫破裂,銀行壞賬、呆賬大面積出現。當局為了所謂的維穩,估計會拚命大量印發鈔票,人民幣會迅速貶值,老百姓口袋裡的錢就被稀釋了,嚴重影響老百姓的日常生活。

徐琳也認為,在短期內,老百姓會受一些損失,比如物價上漲,物資短缺,甚至一定程度上的社會動亂。但這是社會變革時期必經的一個陣痛。

徐琳還指出,最近政治事件頻發,顯示出風雨欲來的景象。包括前政治局常委周永康傳言被抓,貪官接二連三落馬。此外,最近瑞士銀行不再對外籍客戶保密,也使得貪官的海外資產會逐漸的曝光,徐琳認為,這對中共官員來說是很不利的因素,將導致中共政權越來越搖搖欲墜。還有群體事件層出不窮,比如杭州市餘杭區民眾因反對垃圾焚燒項目而舉行示威,東莞鞋廠三萬人舉行罷工抗議薪資不足等。

採訪編輯/秦雪 後製/陳建銘

Le Monde: China’s Housing Market In Panic

French media have recently reported

that “Chinese cities are in panic".

House prices continue to fall in most Chinese cities, aside

from than Beijing, Shanghai, Guangzhou and Shenzhen.

Since this year, there have been several

chairmen of real estate companies that

have gone missing after owing huge debts.

Commentators suggest that China’s

housing bubble will soon burst.

This shift in the economy may also set into motion

the collapse of the Chinese Communist Party (CCP).

Le Monde has reported on housing prices in a recently

developed area close to a high-speed railway station

in Xinbei District of Changzhou city, Jiangsu Province.

The house prices have been continuously dropping.

House owners in the area have responded

with protests for several consecutive weeks,

demanding compensation for their losses.

Mr. Xue, a real estate analyst, told Le Monde that

the Changzhou government had built four residency

areas capable of accommodating 300,000 people.

These new areas are enough to meet the

city’s need for new houses for many years.

On May 10, Tencent’s finance channel reported

that Wang Li, Chairman of Qingdao’s Jun Li Hao

Group Limited, has been missing since April 30.

This was confirmed as another case where real

estate entrepreneurs have escaped after owing

huge debts, due to broken funding chains.

Tencent said Wang owes a huge debt

of over 1.2 billion Yuan ($192 million).

This involves more than three major state-owned commercial

banks, and a number of private loan companies and lenders.

In 2014, China’s house sales have become very poor.

This has lead to funding chain problems for many developers,

and further impacts funding resources for those developers.

Insiders suggest China’s land market

is witnessing an important turning point.

On May 5, Shenyang auctioned off five pieces of land.

However, four of them failed to find buyers, and the only

successful deal was done at almost the starting price.

According to Shenyang’s municipal Land Resources

Bureau, among the five auctioned pieces of land,

three are for business use and two for hybrid use.

The total area is close to 100,000 square meters.

The highest starting price was only

1,584 Yuan ($253) per square meter.

Only three companies took part in the auction.

Cai Lixin, an engineer from Changsha, agrees that

China’s housing market has a serious bubble problem.

Cai Lixin: “There are numerous empty

houses in ghost towns all over China.

In cities such as Erdos, Zhuhai and

Huizhou we see many ghost towns.

That shows how excessive the house supply

is, and the bubble will burst up sooner or later.

Personally, I think that day is not far away."

Li Shaoming, a business owner from Nanchang City,

Jiangxi Province, said the CCP will stop the housing

market from collapsing as much as they can.

Li believes that in the next few years,

prices will continue to increase in China.

However, house prices will not,

leading to depreciation of houses.

Li Shaoming: “China has a unique

regime compared to other countries.

The CCP’s central government has control over all resources.

Therefore, it can use everything to solve the problem.

It has a lot more space than other governments."

Xu Lin, an advanced construction engineer in Guangzhou,

also suggest China’s housing bubble will break soon.

He speculates that it may happen in the second half of 2014.

Xu further commented that once the housing

bubble bursts, the whole regime will collapse.

Xu Lin: “The reason (I say that) is because China’s

housing market is closely linked with the CCP.

The authorities make money from land sales, and many

developers have to take loans from state-owned banks.

In addition, the CCP regime has a lot of

ways of ‘managing’ the housing market.

It can benefit from any regulation it makes.

In one word, the whole regime has all kinds

of connections with the housing market.

Once the housing market collapses, the

CCP regime will be unavoidably involved."

Cai Lixin suggest that China’s housing market

is tied together with the CCP and its banks.

Once the housing bubble bursts, it will

result in massive bad debts for the banks.

In that case, the CCP will probably print money

as much as they can to maintain the regime.

As a result, the Chinese Yuan will depreciate quickly.

Chinese people’s daily lives will be seriously

affected, as their money slips away as such.

Xu Lin said that from a short-term viewpoint, Chinese

people will see economic loss from increasing prices.

They will see shortages of daily goods,

and increasing social tensions.

However, that is an unavoidable pain for

any society as it makes critical reforms.

Xu Lin further comments that political incidents are

occurring more frequently during recent months.

This indicates an upcoming storm in China.

Former Politburo Standing Committee

member Zhou Yongkang was arrested.

A number of corrupt officials were dismissed,

which was very bad news for all CCP officials,

as they were shaking the whole regime, Xu said.

In addition, more large-scale

protests are also seen now in China.

An example is the protests held by Yuhang residents in Hangzhou,

who were standing against a construction plan for a waste plant.

Workers strikes involved 30,000 workers at a shoe factory

in Dongguan, who were protesting against low salaries.

Interview & Edit/Qin Xue Post-Production/Chen Jianming